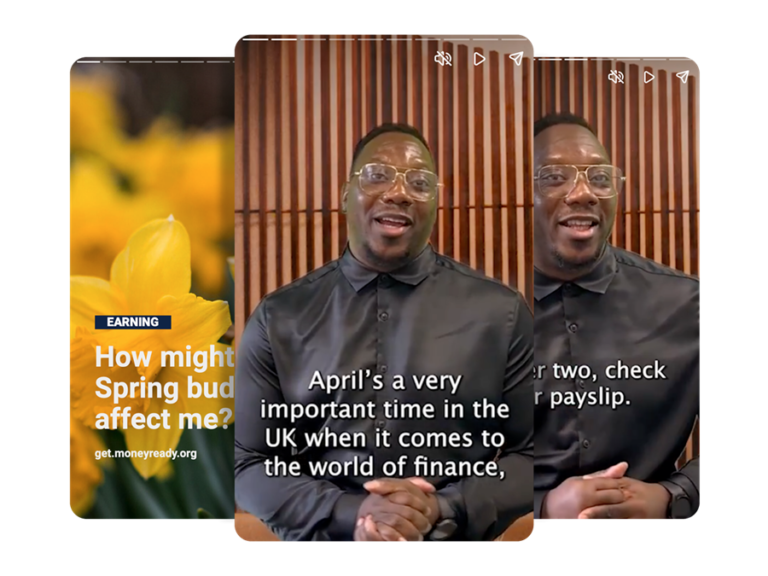

Latest video stories

Every month one of our expert financial education trainers hosts a bite-sized “Insta-style” video, bringing you top tips and guidance, covering everything from banking to borrowing, spending to saving.

Your money questions, answered

Have a question about borrowing or budgeting, earning or saving? Our team of expert trainers have the answers. Check out our knowledge base articles or ask our AI-powered MoneyBot.

Are you Money Ready?

Try our money readiness quiz and find out

Are you Money Ready? What’s your money management style? Are you a Big Spender or an Optimistic Saver? Put your money knowledge and skills to the test to find out.

More ways to get Money Ready

Designed especially for young people, we have lots of ways you can learn about money and boost your financial fitness. Have a finance question you need an answer to? Sign up to receive monthly video content or ask our AI-powered MoneyBot.

Sign up and learn with our monthly newsletter

It’s important to exercise regularly, right? Think and learn about money regularly too with our monthly bite-sizes top tip videos.

Ask our AI-powered MoneyBot

Our AI chatbot is trained on our content and can give you instant answers to your questions based on our trainers’ expert knowledge.

Find out about our in-person programmes

MyBnk offers a wide range of in-person financial education programmes for young people aged 5 – 25.

Can you beat the Nim Bot?

Play our mini game

The aim of the game is to avoid picking up the final, Cursed Coin. If at first you don’t succeed, don’t worry, help is at hand…